Newsletter 66 – Rates

- Posted by IanMuttonAdmin

- On December 16, 2024

Ladies and Gentlemen,

Real Independents, Labor and Greens join forces on a Special Rate Variation (SRV)

Our new Council tells us it is in a weak financial position. If so, what to do?

- Contain costs so that they are covered by current revenue (rates, charges and the sale of assets) or,

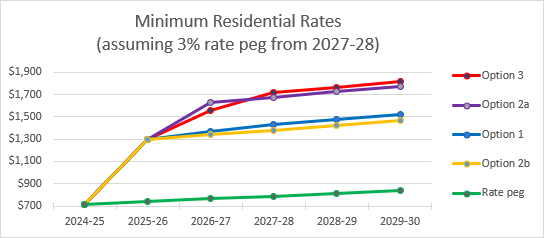

- As Council is suggesting, apply for a breathtaking rate increase of 82% (min residential) and 96% (min commercial)?

The impact on ratepayers will be severe:

Rate rise – do we need one?

The Mayor’s message for the 2022/23 Annual Report was unambiguous:

Council remains in a strong financial position.

Just 5 months ago, the 2024/25 budget was released in June. In that budget there was no mention of a financial crisis.

Prior to the 2024 Council election, nothing was said that suggested Council was in other than a strong financial position.

Then there was an election and after it we were told

Currently, Council’s financial position is very weak, and the financial outlook is unsustainable, requiring significant structural reform.

Why was it left until after the election to inform the North Sydney Community?

The pool myth

The financial impact of the Olympic pool rebuild was evident from early 2023. Despite the Mayor’s warnings about the unsustainable financial pressure, the pool is a long-term asset for future generations. Typically, such assets are funded through long-term liabilities, like borrowing, rather than being paid off in a short period. Council can access low interest loans from NSW Treasury.

Servicing and Extinguishing Debt

If Council does wish to pay off the pool in the short term, then Council’s underperforming commercial property portfolio could be rationalised.

In the real world, debt can be managed by selling assets. In the case of North Sydney Council, the sale of the Ward Street car park and a few retail outlets in Greenwood Plaza would likely deliver near $100m in cash – more than enough to cover the pool.

Structural Reform

Is there a need for structural reform as is now asserted?

Structural reform needs to be addressed by scoping the reforms needed and planning for their implementation.

It is not achieved by simply raising rates. What about Council’s costs? These show no sign of being contained.

Urgent reform requires expenditure be reined in now, not increased by $20m, as is currently proposed for the year ahead, to cover increases in wages and new projects.

Cash at Bank – a barometer of financial health

It’s an old adage that cash at bank is a great indicator of financial health.

In 2023/24 Council budgeted for an operating surplus of $1.6m – but achieved a $13.1m surplus.

This year is also looking healthy. The September 2024 Quarterly Budget Review advised a surplus of near $4 million.

As things stand now, Council expects to have an operating surplus of $6.5m to $8.5m cash, each and every year for the next 10 years.

Without the SRV, Council will add $67m to its cash position. With an SRV, cash increases to $260m in the case of Council’s option 3.

Why on earth does Council need to build a large cash reserve?

Council is letting us down when it fails to consult with the community on ways to contain expenditure and keep it in line with “revenue” from:

- rates and charges,

- the sale of commercial properties it has accumulated over the years

- increasing borrowings.

The ideal solution will invariably be a combination – and the worst outcome will result from the present fixation on raising rates.

What’s now needed is for Council to pause in its hot pursuit of a rate rise and consult the community on the full range of options.

What do you think?

Let me know by email or, if you agree that Council needs to rethink what it is doing, sign the petition – it is critical that you be heard

-

Petition: I oppose Council’s proposed rate increases. Online at

Or scan the QR code

0 Comments